Tax Season Review and Audit Detection Services

Page info

Name Jaunita / Date25-05-13 22:59 Hit11 Comment0Link

Contents

As a tax filing season comes to a close, it is essential for individuals to ensure that their tax returns are legitimate. However, even with the utmost intentions, taxpayers may inadvertently include errors or discrepancies on their returns. This is where tax return review services come into play. Specialized services provide a thorough examination of a taxpayer's return to identify potential areas of concern, helping to prevent expensive audits and penalties.

One of the primary benefits of audit detection services is the reassurance they offer filers. By engaging these services, individuals can have confidence that their return has been meticulously examined and is accurate. This peace of mind can be particularly valuable for individuals who are self-employed or have complex financial situations.

Tax return review services typically involve a comprehensive analysis of the taxpayer's return, including a review of earnings, deductions, and exemptions. Experienced professionals will examine the return for errors, discrepancies, and discrepancies, such as omitted information, mathematical mistakes, or underreported income. They will also check that the taxpayer has claimed all eligible charitable donations, such as charitable donations, mortgage interest, and 税務調査 どこまで調べる education expenses.

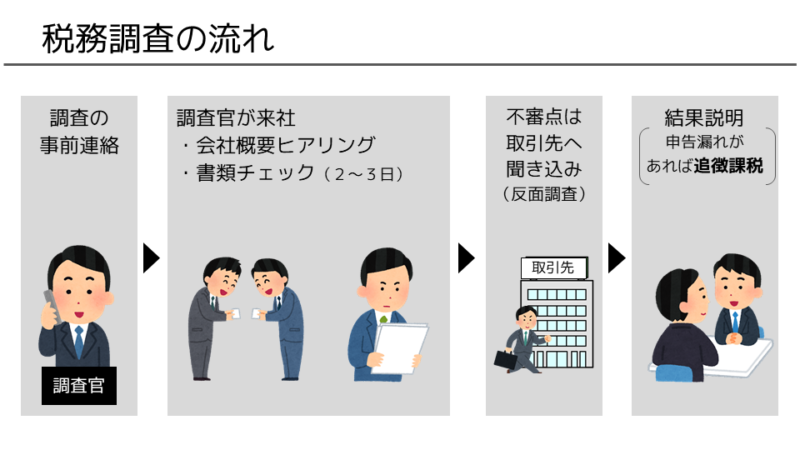

In addition to reviewing the tax return, audit detection services will also examine the taxpayer's financial records, including bank statements, invoices, and receipts. This in-depth review helps to identify potential areas of concern that may trigger an audit, such as suspicious activity or unexplained discrepancies. By addressing these issues proactively, taxpayers can avoid costly audits and penalties, which can have significant financial implications.

Some common signs that a tax return may be at risk of an audit include incomplete or missing information, discrepancies in reported income, and unexplained changes in deductions. Filers who have complicated financial situations, such as multiple sources of income or self-employment income, may also be more likely to be selected for an audit.

To minimize the risk of an audit, taxpayers should ensure that their tax return is accurate, and submitted on time. They should also keep detailed records of their income, expenses, and tax-related documents, including receipts, invoices, and bank statements. By maintaining accurate and organized records, taxpayers can respond efficiently and efficiently to any audit-related inquiries from the tax authorities.

In the event of an audit, filing return review and audit detection services can provide valuable support. Experienced professionals will work cooperatively with the taxpayer to respond to audit-related inquiries, supply documentation, and negotiate a resolution. They will also help taxpayers to understand the audit process, address any questions or concerns they may have, and ensure that their rights are defended throughout the audit process.

In conclusion, tax return review and audit detection services are essential for individuals who want to ensure that their filing returns are complete and minimize the risk of an audit. By engaging these services, filers can have assurance that their return has been completely examined and is accurate, reducing the risk of onerous audits and penalties. Whether you are a retired individual, have complicated financial situations, or are simply inconclusive about your filing obligations, tax return review and audit detection services can provide extensive support and reassurance throughout the filing season.

Warning: Use of undefined constant php - assumed 'php' (this will throw an Error in a future version of PHP) in /home1/icecap/public_html/theme/icecap/skin/board/basic_en/view.skin.php on line 149